Contents

Because it’s expressed in the form of a return, ROIC facilitates comparison to the efficiency of alternative investments which may be out there to the family. Although this might sound a reasonable metric, many companies use financial leverage to raise ROE. Companies usually improve debt ranges to repurchase shares, thereby rising ROE. Using this monetary leverage to affect ROE does not accurately reflect a company’s profitability, returns or lengthy-time period prospects.

Businesses utilize the cash to run their day-to-day operations, invest in new possibilities and expand. Capital employed is simply a company’s total assets less current obligations. Looking at capital utilized is useful since it is used in conjunction with other financial measures to assess the return on a company’s assets as well as how effective management is at capital deployment. The ROIC Formula Return on Invested Capital is calculated by taking into account the cost of the investment and the returns generated. Returns are all the earnings acquired after taxes but before interests are paid.

The company’s high ROIC, in this case, reflects returns on initial invested capital rather than the incremental invested capital. In other words, a 20% reported ROIC today is not worth as much to an investor if there aren’t anymore 20% ROIC opportunities roic meaning to reinvest the profits. Mature legacy moat businesses with high dividend yields may preserve capital, but they are not particularly good at compounding wealth. When all other factors are equal, a higher ROIC is always preferable.

The trend of ROCE over the years is also an important indicator of a company’s performance. Investors trust those companies which have stable and growing ROCE over those companies whose ROCE is volatile. Also, net working capital plus net fixed capital is used in place of fixed assets as it gives a better picture of how much capital is needed to run the business.

Attention Investors:

Now that you’ve understood what ROCE and ROIC are, let’s take a look at the key differences between these two profitability ratios. Greenblatt says this approach is simple enough and is especially beneficial for investors who are just starting their careers in investing or the ones who are considering to manage their own equity portfolios. The formula finally gives the best combined rankings of companies that an investor can buy and hold for at least a year. After one year, one should review all the companies and move funds to the new highly-ranked companies using the same formula. The ‘Magic Formula’ provides both the ratios equal weightage while selecting companies.

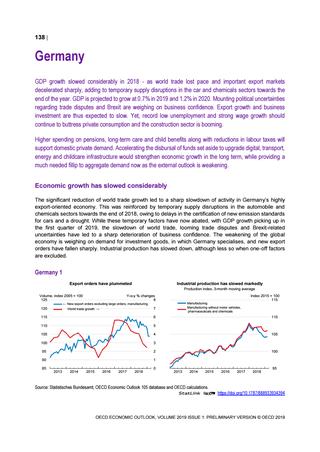

When growth is scarce, market breadth narrows, and demand-supply dynamics take over. (Most investors remain in denial during this stage, as these expensive stocks continue to rise in price.) When growth finally slows, the valuation de-rating begins. Return on capital employed is determined by dividing net operating profit, also known as earnings before interest and taxes , by the amount of capital employed. Another method is to divide profits before interest and taxes by the difference between total assets and current liabilities.

More specifically, the return on funding capital is the percentage return that an organization makes over its invested capital. However, the invested capital is measured by the monetary value wanted, as an alternative of the property that had been bought. Therefore invested capital is the amount of lengthy-term debt plus the amount of common and most well-liked shares. Competitive advantage is defined as a company’s ability to generate “excess returns,” that is, ROIC less cost of capital.

The Difference Between ROCE and ROIC

The reply is dependent upon whether or not the company can earn more on the extra funds as measured by its return on property than its opportunity price, usually represented as the combination return of the stock market. Return on invested capital is a strong device for not just evaluating how your family enterprise has performed prior to now, but in addition for charting a course for future enchancment. Return on invested capital is a calculation used to assess a company’s efficiency at allocating the capital beneath its management to profitable investments.

- Return on Invested Capital is a measure of return that may be helpful to all professions in finance.

- Efiling Income Tax Returns is made easy with ClearTax platform.

- The author is a Certified Financial Planner with 5 years experience in Investment Advisory and Financial Planning.

- The good one offers a competitive interest rate, which is also earned on additional deposits.

ROIC is always calculated as a percentage and is normally expressed as an annualized or trailing 12-month value. It ought to be in comparison with an organization’s price of capital to find out whether the corporate is creating worth. If ROIC is bigger than a agency’s weighted average cost of capital , the commonest value of capital metric, value is being created and these companies will trade at a premium. Once your family shareholders and fellow administrators get a really feel for it, ROIC is more likely to turn into a go-to software for developing, refining and evaluating corporate technique. Examining ROIC by way of the lens of turnover and revenue margin begins to lay naked how the household business’ trade and technique influences monetary performance.

The highest Retail Opportunity Investments Corp. stock price was $ 19.46 till 5th Feb 2023 within the past 52 weeks. Invest in stocks with https://1investing.in/ Free Expert Advice only with MO INVESTOR. The good one offers a competitive interest rate, which is also earned on additional deposits.

Rough benchmarks for analysing a firm’s ROIC

This means for every hundred rupee of capital employed, ITC Ltd makes Rs 32.60. Unless the valuation of the Land+building is dramatically higher (for e.g.in the case of the Mumbai’s erstwhile Textile Mills or current land held by Amrutanjan- if I recollect correctly) it would not be worthwhile to value the same. 24 years old Early Childhood (Pre-Primary School) Teacher Charlie from Cold Lake, has several hobbies and interests including music-keyboard, forex, investment, bitcoin, cryptocurrency and butterfly watching. Is quite excited in particular about touring Durham Castle and Cathedral. ROIC is a a lot better predictor of firm efficiency than either return on property or return on fairness.

Capital expenditures are reserved to support only the corporate’s absolute core competency. It can shift from a wholesale or retail technique to a direct-to-shopper strategy. Net revenue margin is one other metric that doesn’t accurately reflect investor returns. However, buyers must be concerned with the return on investors’ dollars, not clients’ dollars. This includes shareholders’ equity and other long-term debt obligations such as loans and borrowings that a company would have availed to further its business. However, a high ROIC alone does not necessarily mean a company is highly profitable.

What is Return on Capital Employed?

ROIC can be a useful tool in comparing the relative profitability of one company with another as well as determining how a company’s profitability might have changed over time. For example, if a company’s ROIC improved from 10% in its first year to 12% in its second, that means that for every Rs 100 of the company’s invested capital, it produced Rs 10 in profit the first year and Rs 12 the next. Return on invested capital, or ROIC, is one of many metrics for assessing the profitability of a company.

The Holy Grail Of Long-Term Investing

Her goal is to make common retail investors financially smart and independent. ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services. ROIC is an indicator that helps understand how productive a company’s operating assets are. You may also like to learn more on other returns-linked profitability measures, as below.

Return on invested capital indicates how profitable and sustainable a business is. Please read all scheme related documents carefully before investing. For example, if two businesses have the same current ROIC of 20%, Company A can invest twice as much as Company B at that 20% rate of return. As a result, company A will create much more value for its owners over time than Company B. Both businesses will produce a 20% ROIC, but one is superior to the other. As a result, company A can reinvest a more significant portion of its earnings, resulting in more intrinsic value over time.